In today's rapidly evolving digital landscape, the financial industry is undergoing a revolutionary transformation driven by the convergence of technology and finance, commonly known as Fintech. This article delves into the intricate world of Fintech, exploring its trends, innovations, and implications for businesses and consumers alike.

Table of Contents

- Introduction

- Defining Fintech and its Evolution

- The Role of Artificial Intelligence and Big Data

- Blockchain and Cryptocurrencies: Shaping the Future of Transactions

- Digital Payment Solutions: Enhancing Financial Accessibility

- Insurtech: Revolutionizing the Insurance Sector

- Robo-Advisors and Wealth Management

- Regtech: Navigating Regulatory Challenges with Technology

- Biometrics and Enhanced Security in Financial Services

- The Rise of Neobanks and Challenger Banks

- Fintech and Financial Inclusion

- Sustainable Finance and ESG Investments

- Cross-Border Payments Simplified

- Challenges and Risks in the Fintech Landscape

- Future Prospects and Concluding Thoughts

1. Introduction

The financial services landscape is undergoing a seismic shift propelled by technological advancements. Fintech, short for financial technology, encompasses a wide array of innovations reshaping how we conduct transactions, manage wealth, and access financial services. This transformation is not only enhancing convenience but also democratizing financial access across the globe.

2. Defining Fintech and its Evolution

Fintech refers to the use of technology to enhance and automate financial services. Its evolution can be traced back to the 1950s with the advent of credit cards, but the recent surge in digitalization has truly revolutionized the industry. As smartphones became ubiquitous and internet connectivity improved, Fintech gained a fertile ground to flourish. From mobile payments to robo-advisors, Fintech is now integral to the financial ecosystem.

3. The Role of Artificial Intelligence and Big Data

Artificial Intelligence (AI) and Big Data analytics are driving the Fintech revolution. From personalized banking experiences to fraud detection, AI-powered algorithms are making financial processes smarter and more efficient. AI analyzes vast amounts of data to provide insights into consumer behavior and tailor financial services to individual needs. This not only improves customer satisfaction but also reduces risks and enhances security.

4. Blockchain and Cryptocurrencies: Shaping the Future of Transactions

Blockchain's decentralized and secure nature has paved the way for cryptocurrencies like Bitcoin. These digital assets are changing the landscape of transactions and challenging traditional banking systems. Blockchain's distributed ledger technology ensures transaction transparency and security, reducing the need for intermediaries. Cryptocurrencies enable fast and cost-effective cross-border transfers, potentially transforming remittances and international trade.

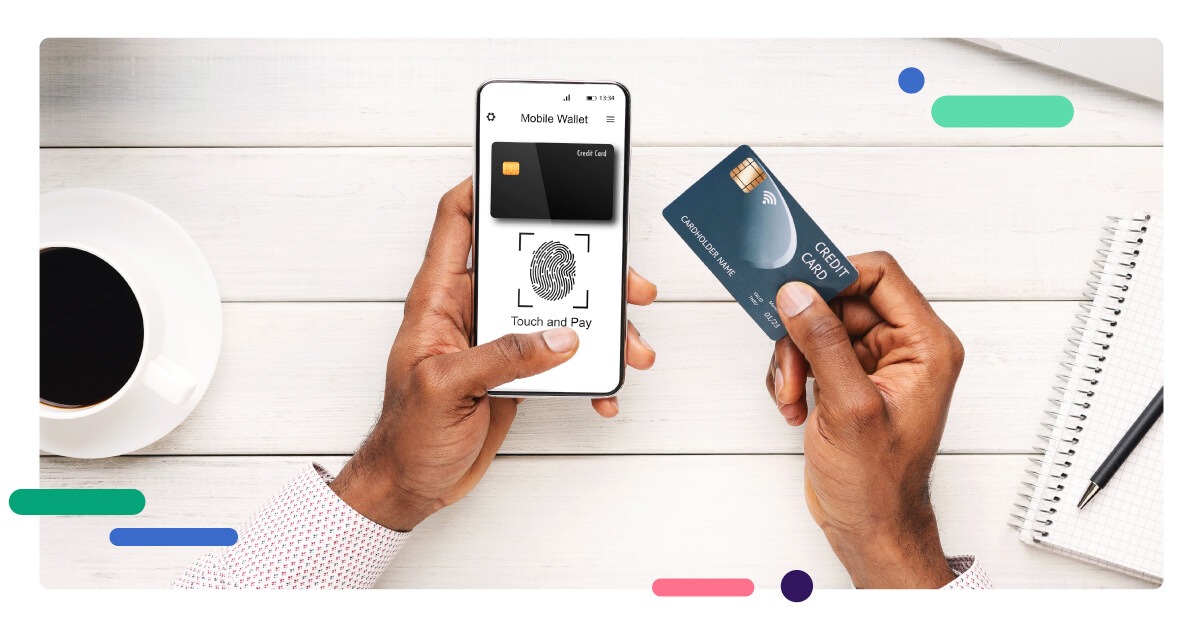

5. Digital Payment Solutions: Enhancing Financial Accessibility

Digital payment platforms are providing seamless and inclusive solutions for transactions. These technologies are reshaping how money is exchanged, from mobile wallets to peer-to-peer transfers. For the unbanked population in remote areas, digital payments offer a gateway to financial services that were previously inaccessible. Moreover, these solutions reduce the dependency on physical cash, contributing to financial hygiene and transparency.

6. Insurtech: Revolutionizing the Insurance Sector

The insurance industry is embracing technology to streamline processes, assess risks more accurately, and provide personalized policies, making the experience more convenient for customers. Insurtech utilizes AI and data analytics to evaluate a customer's risk profile and offer tailored insurance coverage. This benefits customers and enables insurance providers to optimize their offerings and minimize fraudulent claims.

7. Robo-advisors and Wealth Management

Robo-advisors are using algorithms to provide automated investment advice. They democratize wealth management by offering cost-effective solutions catering to a broader range of investors. These platforms assess investors' risk tolerance and financial goals to create customized investment portfolios. The accessibility of robo-advisors is particularly attractive to millennials and individuals who may have been excluded from traditional wealth management services.

8. Regtech: Navigating Regulatory Challenges with Technology

Regtech, or regulatory technology, is helping financial institutions comply with regulations efficiently. Automation and data-driven approaches are simplifying the compliance process. With the ever-changing regulatory landscape, financial institutions are turning to technology to ensure adherence to complex rules and reporting requirements. Regtech solutions reduce the risk of non-compliance and associated penalties.

9. Biometrics and Enhanced Security in Financial Services

Biometric authentication, including fingerprint and facial recognition, bolsters security in financial transactions, reducing the risks associated with traditional passwords. Biometrics provides a higher level of security and convenience. They eliminate the need to remember complex passwords and provide protection against identity theft and unauthorized access.

10. The Rise of Neobanks and Challenger Banks

Neobanks and challenger banks are redefining traditional banking. With their digital-first approach and customer-centric services, they are gaining traction globally. These banks offer intuitive mobile apps, low fees, and personalized financial insights. Neobanks are not burdened by the legacy systems of traditional banks, allowing them to be agile and innovative in their service offerings.

11. Fintech and Financial Inclusion

Fintech is bridging the gap between the unbanked population and financial services. Mobile banking and digital payment options are extending financial inclusion to underserved communities. Through mobile devices, even individuals without access to traditional banking infrastructure can now manage their finances, access credit, and participate in the economy.

12. Sustainable Finance and ESG Investments

Environmental, Social, and Governance (ESG) considerations are becoming integral to investment decisions. Fintech is facilitating the growth of sustainable finance by providing tools to assess ESG performance. Fintech platforms offer data-driven insights into a company's environmental impact, social responsibility, and governance practices, empowering investors to make informed decisions aligned with their values.

13. Cross-Border Payments Simplified

Fintech innovations are making cross-border payments faster, cheaper, and more transparent. Blockchain and digital payment platforms are eliminating intermediaries and reducing transaction costs. High fees, long processing times, and a lack of transparency often marred traditional cross-border transactions. Fintech solutions are revolutionizing this space by enabling real-time, secure, and affordable cross-border transfers.

14. Challenges and Risks in the Fintech Landscape

While Fintech offers numerous benefits, it also comes with challenges, such as regulatory uncertainties, data breaches, and cyber threats. Striking a balance between innovation and security is crucial. Regulations are still catching up with technological advancements, and Fintech companies must navigate a complex web of compliance requirements. Additionally, the digital nature of Fintech makes it susceptible to cyberattacks and data breaches, necessitating robust cybersecurity measures.

15. Future Prospects and Concluding Thoughts

The future of Fintech holds tremendous potential. As technology advances, we can expect further integration of AI, expansion of digital banking services, and the emergence of new, yet unimaginable, innovations. Fintech will continue to shape the financial landscape, making financial services more accessible, efficient, and tailored to individual needs.

FAQs

What is Fintech?

Fintech stands for financial technology, which refers to the use of technology to enhance financial services.

How is AI shaping the Fintech industry?

AI is transforming Fintech by powering intelligent algorithms that streamline processes and enhance user experiences.

Are cryptocurrencies secure?

Cryptocurrencies rely on blockchain technology, which offers robust security through decentralization and encryption.

What are neobanks?

Neobanks are digital-only banks that operate without physical branches, offering convenient and user-centric financial services.

What role does Fintech play in sustainable finance?

Fintech provides tools for assessing Environmental, Social, and Governance (ESG) factors, promoting sustainable and responsible investments.